Tackling Insurance Fraud with IBM i2 Fraud Intelligence Analysis

It is estimated that insurance fraud costs the industry more than £1 billion a year despite recent measures that have been taken to tackle the problem.

Typically incidents of fraud can range from fake or exaggerated insurance claims (such as for personal injury or contrived accidents), provision of false information to get insurance cover on more favourable terms or deliberate destruction of assets in order to make claims. This type of insurance fraud could include motor vehicle, commercial, household and other personal insurance claims.

Not only does fraud directly impact an organisations’ profitability, it also has a damaging effect on an organisations’ reputation and regulator relationships. In addition, it can potentially lead to significant fines and long term damage to shareholder value.

Compounding this problem even more is the ever increasing amount of data. As customers interact with their provider over a variety of channels, the volume, variety and velocity of data increases, making fraud detection and investigation more complex. With public awareness of the costs of fraud increasing, insurers who adopt a proactive response to fraud will have a competitive advantage. In addition, a response that enables investigation and documentation of suspicious claims will also greatly assist insurers in the repudiation process as well as reduce claim leakage.

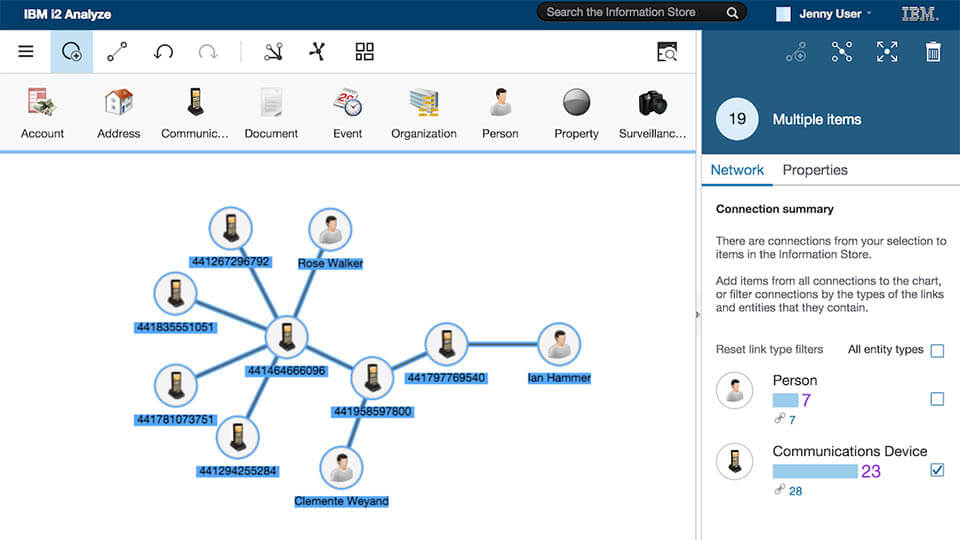

IBM i2 Fraud Intelligence Analysis delivers critical insights for investigating complex incidents; producing timely, actionable visualisation of people and events; and documenting results in easily digestible formats for repudiation and potential litigation.

key features

• Data: Connect analysts and investigators directly to structured and unstructured data sources to turn disparate data into actionable intelligence.

• Analytics and visualisation: Vast quantities of data from unrelated sources can be analysed and visualized in a number of rich formats to uncover hidden patterns of abnormal behaviour.

• Collaboration and investigation: i2 Fraud Intelligence Analysis provides a collaborative investigative environment, enabling analysts and investigators to build and leverage fully auditable customer and fraud intelligence.

Solution content

- Project definition workshop

- Installation of the client and server applications and Analyst’s Notebook plug-in.

- Design of search service(s), accompanying forms, i2 data model and charting schemes.

- Import of selected data sets into iBase database

- Connector implementation /configuration

- Iterative playbacks and reviews with end-users.

- Technical hand-over and end-user enablement.

Implementation

i2 Fraud Intelligence Analysis utilises both a traditional database (iBase) and Web-services technology (i2 Connect). Simple iBase implementations can take as little as 10 days to install and configure. i2 Connect search services can take hours using out of the box functionality and pre-built connectors. A more bespoke solution (including development of custom connectors or multiple complex iBase imports) will take longer.

Engage today with a world-wide team of highly trained professionals, the IBM Product Professional Services team and Brookcourt Solutions can help build your solution with confidence while assuring that the business needs and expectations of your organisation are met.

contact@brookcourtsolutions.com